Whether you own a fleet or a single truck, you’re likely aware of how expensive trucking insurance can be. The cost of insuring a truck versus a company car can be thousands of dollars in difference. This is due to many factors, some of which are out of your control.

Weight

The weight of the truck affects truck insurance rates. Heavier vehicles require higher coverage limits, and so cost more to insure. This is in part due to the amount of damage a heavier vehicle can cause compared to a lighter one, as well as the difficulty of stopping suddenly.

Location

Some areas charge more for trucking insurance. If your truck or trucks operate primarily on busy highways or in neighborhoods with a high cost of living, trucking insurance rates will be higher. Rates may also change depending on the distance intended to travel. Interstate truckers generally pay more for insurance than intrastate truckers.

Cargo

The type and value of cargo in transport affects the cost of trucking insurance. Each state has different laws and regulations on trucking insurance and cargo. Trucks that transport people (passenger carriers) or hazardous material will pay more to compensate for the potential risk of damage and injury in an accident.

While there are many factors of trucking insurance that cannot be changed, there are some the policyholder can influence.

Driving Record of Truckers

A driving record is perhaps one of the most influential factors on car and trucking insurance. If there are multiple people driving for a company or sharing a truck, each of their driving records can affect the cost of insurance. Do comprehensive background checks on each driver to ensure they won’t skyrocket insurance prices.

Claims History

Another factor is the claims history of the business and the policyholder. A policyholder with a long list of previous claims may have trouble finding affordable trucking insurance. Before filing a claim, have the damage appraised. If the cost to fix the damage out of pocket is cheaper than the cost of your deductible, it may be wiser not to file an insurance claim.

Credit Score of the Insured

The policyholder’s credit score can also affect insurance rates. Work to build your credit by paying of loans, debts and credit cards and pay bills on time in order to avoid hits to your credit. A good credit score can help save on trucking insurance.

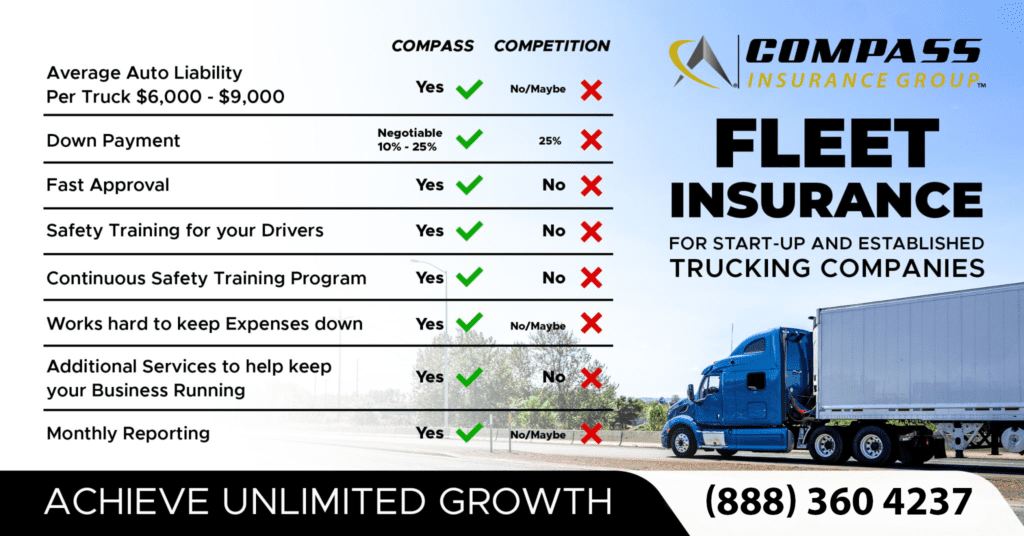

Despite the fact that we found out what all affects the cost of insurance. Surely you are wondering how we are different from others?

You can take a look right here at the benefits of RRG (risk retention group with our affiliate company). They also do non-RRG insurance for trucking companies. You can call them at 888-360-4237 and talk to an insurance specialist.