Number of container ships at Los Angeles/Long Beach is now 4.8 times pre-COVID levels

From anchorage stats to forward arrivals, ocean bookings, and inventory-to-sales numbers, all the latest data paints the same picture: The U.S. congestion crisis has never been more severe than it is now — and it’s getting worse.

Hope for any relief this year has vanished. French carrier CMA CGM is the latest in a long line of market participants to push back its timeline on normalization. Capacity constraints “are expected to continue until the first half of 2022,” CMA CGM warned on Friday.

Alarmingly, America’s import system — which is already stretched to the limit — looks like it will have to handle even higher volumes next month. The likely outcome: Carriers will be forced to cancel more sailings as terminal berths max out and ships get stuck at anchor, even more cargo will get “rolled” (pushed to a future sailing), and importers will face even longer delays and even less slot availability as they scramble to build inventories for holiday sales.

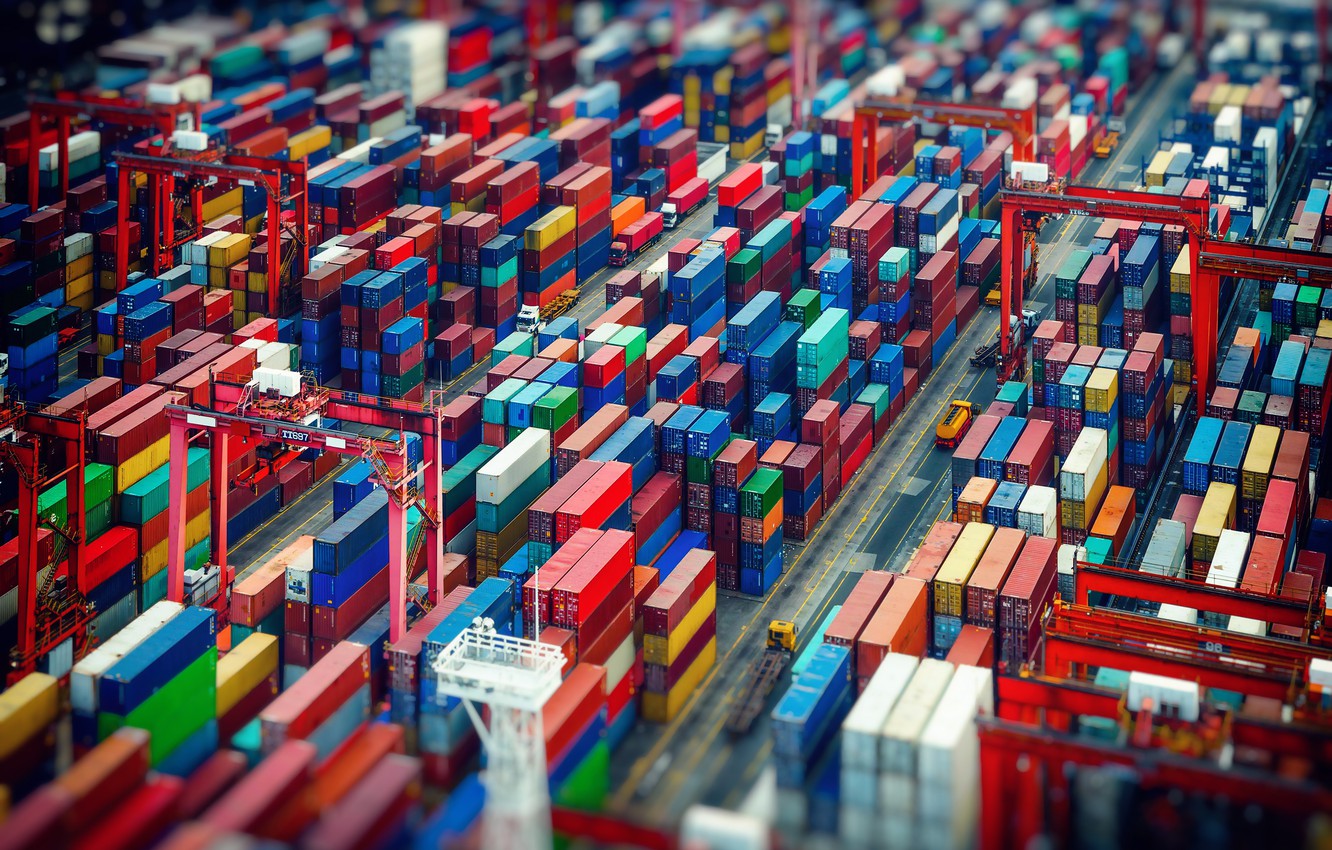

More ships stuck at anchor than ever before

According to the Marine Exchange of Southern California, there were 47 container ships at anchor or drifting off the ports of Los Angeles and Long Beach on Sunday, a new all-time high. The earlier high of 40 at anchor was set on Feb. 1 and matched several times last week. The tally rose to 44 on Friday and stood at 46 on Monday.

Pre-COVID, an average of 16 container ships were at berths or at anchor on any given day (with any ships at anchor being a rare occurrence). On Sunday, there were 76 box ships either at berths, at anchor or drifting — 4.8 times the pre-COVID level.

There are now almost 60% more container ships at anchor than at berth. The Marine Exchange data shows that Los Angeles/Long Beach terminals accommodated an average of 28 ships each day this month. All the rest is overflow that heads to the so-called “parking lot” in San Pedro Bay.

Automatic identification system (AIS) ship-positioning data from MarineTraffic revealed extreme congestion in Southern California on Monday, with more than a half-dozen ships forced to drift because anchorage spots were full.

Even higher volumes on the way

“The expected spike in imports generated by the peak season and pre-shipped cargo is already here, making the operation more complex,” said Hapag-Lloyd on Friday, referring to congestion in Los Angeles and Long Beach. Hapag-Lloyd said that it does not expect California anchorages to clear in 2021.

The Port of Los Beach’s WAVE report, which estimates future arrivals, predicts volumes will rise in the weeks ahead. It forecast loaded import volumes of 120,928 twenty-foot equivalent units for the last week of September, up 34% from the estimated 89,980 TEUs of imports due to arrive next week.

Signal, the Port of Los Angeles’ planning tool, shows a more extreme upward trend. It projects import volumes of 190,937 TEUs for the week of Sept. 12-18, roughly double projected import volumes this week.

Another forward indicator is a proprietary index of shippers’ bookings on FreightWaves’ SONAR platform. The index has risen sharply in recent weeks, implying higher volumes arriving at U.S. ports in late September and into October.

Inventories not even close to being replenished

Despite record imports in the first eight months of this year, U.S. retail sales continue to outpace inventory replenishment.

Assuming sales don’t collapse and businesses seek to reach pre-COVID inventory-to-sales levels, imports still have a long way to run due to restocking.

The Institute for Supply Management (ISM) produces a monthly report that includes an index of sentiment on customer inventories. That index fell to 25 points in July, the lowest level in its history.

The Bureau of Economic Analysis publishes detailed monthly data on retail inventories and inventory-to-sales ratios. While there is a lag — the June numbers were published on Friday — the data underscores the magnitude of America’s inventory restocking challenge.

Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business, provided inflation-adjusted BEA figures excluding motor vehicles and automotive parts (which skew the data). This data shows that retail inventories are now substantially higher than pre-COVID, but sales have been so high that the inventory-to-sales ratio is far below where it was pre-COVID. The level of inventory to sales actually fell slightly in June, to 0.94 months of sales.

Miller also compared the June sales and inventory figures for specific categories of wholesale and retail imports.

The rise in sales far outpaced the rise in inventories — in some categories, inventories fell — which helps explain the ongoing flood of cargo into U.S. ports and the unprecedented pileup of ships at anchor off Los Angeles/Long Beach.

Source: www.freightwaves.com